Introduction to Corporate Finance

Introduction to Corporate Finance

What is a Corporation, anyway? Think about any business opportunity, like opening a small pizza vendor facility…

- On the one hand, there is an endless variety of real assets needed to carry on such business

- On the other hand, these assets simply do not come for free – there has to be some way to acquire them!

Broadly speaking, these are:

- Investment Decisions \(\rightarrow\) acquisition of real assets - e.g, oven, machinery, powerplant

- Financing Decisions: \(\rightarrow\) sale of financial assets - bank financing, equity

Not surprisingly, these decisions are intertwinned:

- While Investment decisions define what is the set of assets to be organized…

- Financing decisions define how these assets will be acquired!

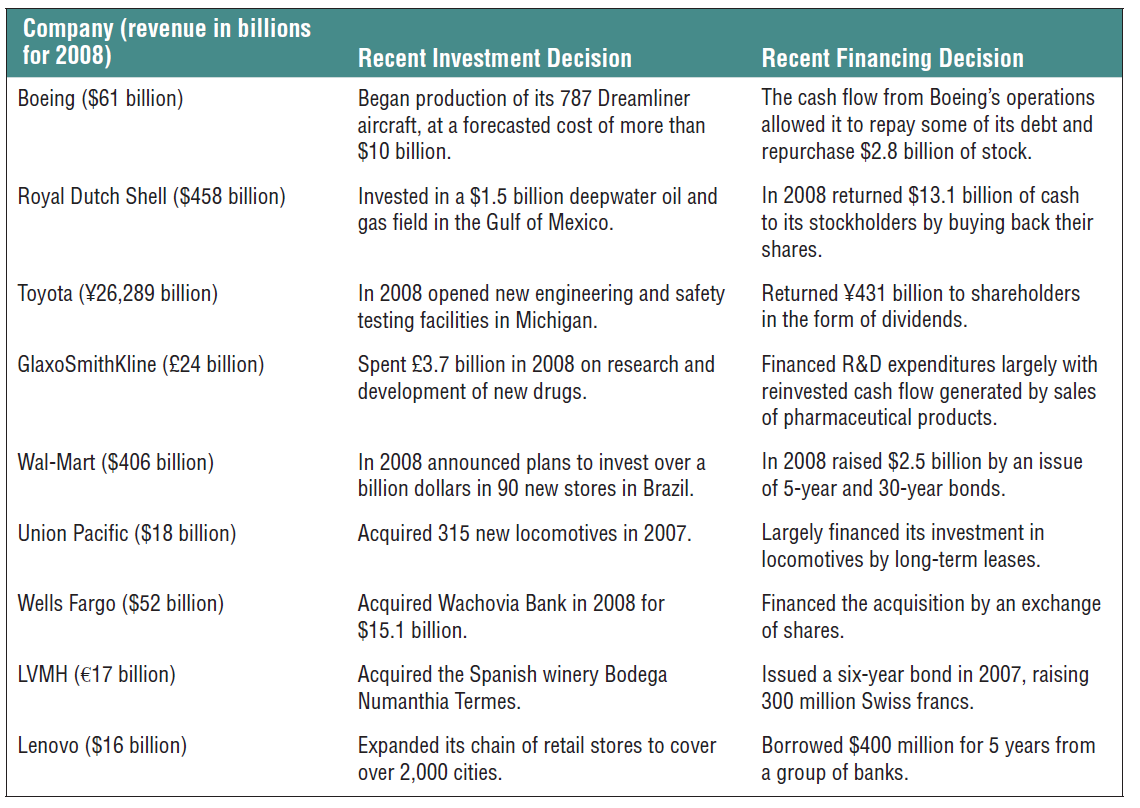

Examples of Investment and Financing Decisions

Investment Decisions

Investment decisions are generally thought of as a capital investment made today to generate returns in the future

The extent to when these returns are expected to happen depends on the specific investment

Examples of Investment decisions:

- Research and Development (R&D) on creating/optimizing new products/services

- Machinery, Property, Pland, and Equipment

- Opening new stores

- Acquiring an operation from a company

- Expanding trade credit to leverage sales

- Stock up warehouses with inventory during high seasonality

Financing Decisions

After you decide on what to invest: how are you going to fund it?

Overall, a firm can raise money by two ways:

- A firm can borrow money from a lender \(\rightarrow\) firm receives the money, but now has a promise to pay back the debt plus interest

- Alternatively, the firm can raise money from the shareholders \(\rightarrow\) equity financing

The choice between the amount of equity vs is often referred to Capital Structure decisions

Within each type of financing, there are specific decisions that increase the complexity:

- Would the firm be better-off by having a 1-year or 20-year financing? Should it include collateral or not? Fixed or variable interest rate?

- For equity financing, should the firm issue new equity or reinvest profits into its operations?

- Question: between investment and financing, which one is the most important?

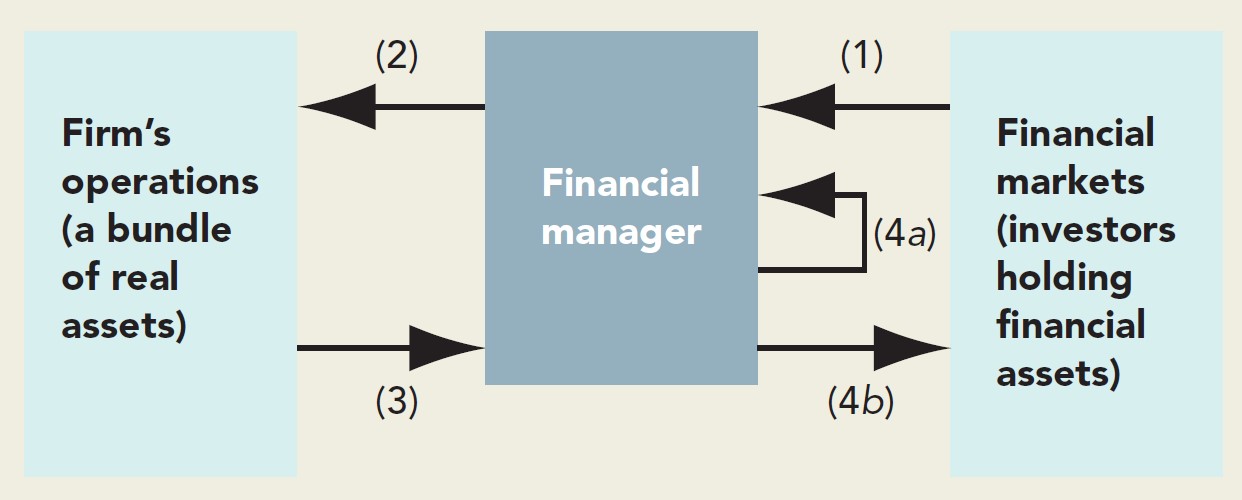

Managing investment and financing decisions

We saw that any business opportunity must be accompained by an investment and a financing decision

Managing these decisions is a hard task, especially if you have to conduct the front-end of the business altogether

To this point, there has to be someone to organize these flows on behalf of the firm…

The role of the Financial Manager

- A Financial Manager1 stands between the firm and outside investors:

- On the one hand, it helps managing the firm’s operations, particularly by helping to make good investment decisions

- On the other hand, it deals with investors such as shareholders and financial institutions

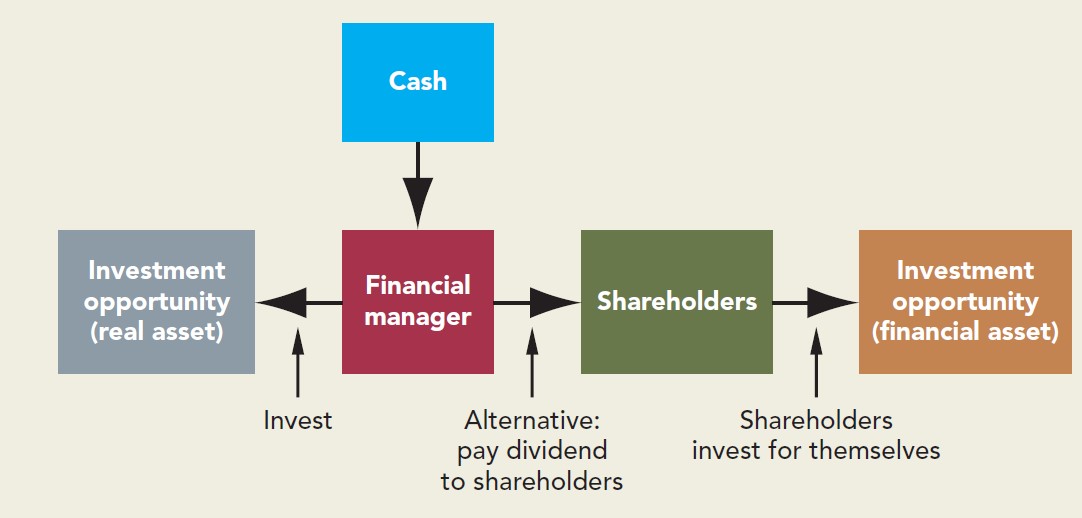

The Investment Trade-off

- Suppose that firm has a proposed investment project (a real asset) and has cash on hand to finance the project

- The Financial Manager has to decide whether to invest in the project:

- If investing, cash goes to fund the project

- If not investing, the firm can then pay out the cash to shareholders as an extra-dividend

The Investment Trade-off, continued

Assume that this financial manager acts on behalf of the shareholder’s interests. What do they want the financial manager to do?

The answer depends on the project’s rate of return:

- If the return offered by project is higher than what the shareholders can get elsewhere investing on their own \(\rightarrow\) shareholders would be better off with the project

- If it offers a return rate that is lower than what the shareholders can achieve on their own \(\rightarrow\) shareholders would be better off by having the cash on their hands

This decision is tied to an important concept called the opportunity cost of capital:

- Whenever a corporation invests in a project, its shareholders lose the opportunity to invest the cash on their own

- Corporations increase value by accepting all investment projects that earn more than the opportunity cost of capital.

Ibovespa and interest rate dynamics

How to take actions on behalf of the shareholders

- Shareholders differ in several dimensions:

- Age

- Tastes

- Consumption Patterns

- Wealth

- Risk Aversion

- Investment Horizon

Question: which criteria should the Financial Manager use to take investment and financing decisions?

- Fortunately, there is a widely accepted criteria: maximize the current market value of shareholders’ investment!

Shareholder Value Maximization

Maximizing shareholder wealth is a sensible goal when the they have access to well-functioning financial markets:

- Financial markets allow them to share risks and transport savings across time

- It also gives them the flexibility to manage their own savings and investment plans

Why it works like this? Assume that the Financial Manager acts on behalf of the stockholders of the firm. A plausible assumption is that:

- Shareholders want to be as rich as possible…

- And transform such wealth into his/her specific consumption pattern via borrowing/lending

- Finally, shareholders need to manage the risk of his/her chosen consumption pattern

Note that points 2 and 3 can be done by the shareholder

How then can the financial manager help the firm’s stockholders? Increasing their wealth!

The separation of ownership and control

When we introduced the figure of the Financial Manager and the existence of financial markets, we implicitly discussed the separation of ownership and control

In other words, the shareholders of the firm cannot fully control what the managers do

Is this a problem? Up to now, we are assuming that the Financial Manager should look after the interests of the shareholders

Although this separation is necessary, there are reasons to think that managers could pursue their own objectives:

- Maximize their bonuses

- Pass attractive, but risky projects to increase job safety

- Overinvest to show hard work

- Take on too much risk as the downside will be ultimately borne out by the shareholders

The Agency Problem

Definition

The Agency Problem is a coordination issue present in corporate decisions. Between the manager and the shareholders of the firm:

- The manager (or the agent) does not have incentives to maximize shareholder value; and

- Shareholders (the principals) need to incur in monitoring costs to constrain value-destroying decisions

- That sets up the stage for Corporate Governance: the design of actions that aims to align the interests of the different stakeholders of the firm and reduce Agency Costs

- Examples of internally enforced Corporate Governance mechanisms:

- The creation of a Board of Directors

- Compensation plans based on metrics that are tied to maximizing shareholder value (stock options, restricted stock units, variable compensation, etc)

- Voluntary adoption of Corporate Governance principles, such as ESG practices

The Agency Problem, continued

Definition

The Agency Problem is a coordination issue present in corporate decisions. Between the manager and the shareholders of the firm:

- The manager (or the agent) does not have incentives to maximize shareholder value; and

- Shareholders (the principals) need to incur in monitoring costs to constrain value-destroying decisions

- That sets up the stage for Corporate Governance: the design of actions that aims to align the interests of the different stakeholders of the firm and reduce Agency Costs

- Examples of externally enforced Corporate Governance mechanisms:

- Legal and regulatory requirements - SEC (U.S), Comissão de Valores Mobiliários (CVM) (Brazil)

- Hostile Takeovers and Market Monitoring

- Shareholder Pressure, also called the “Wall Street walk”

Supplementary Reading

After-class reading (available on e-Class):

Carbon Credit Markets

What Every Leader Needs to Know About Carbon Credits